Reading Table Information for Completion of Table and Column Names

If you lot desire to keep upward with loan payments, peculiarly when it comes to a fixed-involvement loan, using an amortization table can be incredibly helpful. Not only can a loan amortization table assistance you proceed up with your monthly payments, but it'south besides great for understanding your involvement costs every bit the loan remainder decreases. Not familiar with how an amortization table works? Don't worry — we'll walk you through how to make, read, and use one.

What Is an Amortized Loan?

An amortized loan is a type of loan with scheduled payments that go toward paying off both the loan's principal amount and interest. Most types of loans that yous pay back on a monthly basis tend to be amortized loans — call up auto, home equity, and personal loans. Another great example of this type of loan construction is a fixed-charge per unit mortgage.

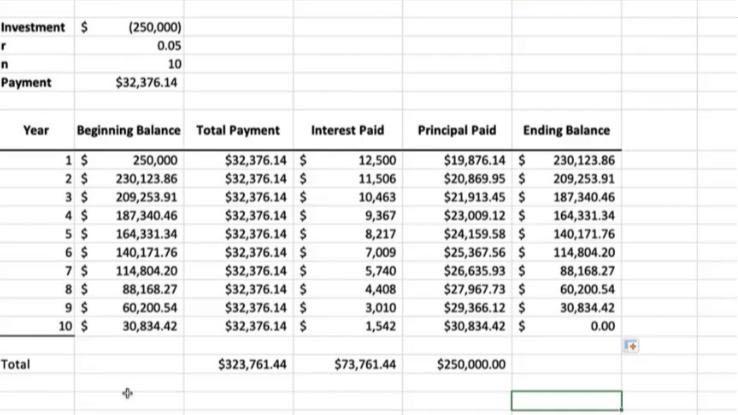

When you brand monthly payments on an amortized loan, part of your payment goes to paying off interest, while the residue goes towards paying off your principal. An amortization table is a handy fashion to calculate how much of your monthly payment is going to each category, specially since this ratio will change as your full balance decreases.

The average amortization table calculates several things, including:

- Monthly Residual: This cavalcade keeps a record of your total remaining balance.

- Monthly Payment: If you accept a fixed-rate loan, this column will likely include the same payment amount each calendar month. One time you make your payment, you lot'll exist able to subtract it from the monthly balance.

- Involvement Paid: This is where y'all'll encounter how much of your monthly payment is going toward the interest. In order to notice this effigy, multiply your remaining loan balance by your monthly involvement charge per unit.

- Principle Paid: Once you figure out how much of your payment went toward paying off interest, decrease that number from the unabridged payment you fabricated. The remaining coin will be the corporeality that went toward your master.

- Remaining Rest: This is the new monthly balance you lot'll start with for the side by side month's payment. In other words, decrease your payment from the old monthly residue to find the new remaining balance.

When you first first making payments, you'll find that your interest costs are at their highest. As you make more payments, however, there will be less and less chief to charge interest on. In turn, you'll notice that a piddling more of your payment will go toward paying off your chief.

Making your own amortization chart using Microsoft Excel, or even using an Excel loan payment template, can be a great, immediate way to see how information technology all works. There's fifty-fifty a costless website called amortization-calc.com that's able to exercise the math for you, so long as you input your loan type, amount, involvement rate, and term.

In addition to helping you lot look alee to future payments, an amortization chart can come in handy before you even take out a loan. For example, while it may initially seem like making the everyman possible payment every month is the manner to go, a loan amortization figurer may tell a different story. That is, in some cases, by paying less each month — or selecting a longer repayment term — you may end up paying far more interest in the long run.

So, before settling on repayment terms, effort running a couple of options through an amortization table to see what will yield the all-time charge per unit overall. This strategy can also help you lot decide whether refinancing a loan or, if possible, paying information technology off early on is the way to become.

Loans That Do and Don't Work With an Amortization Chart

As helpful every bit an acquittal loan chart can be, it can not exist used in conjunction with every type of loan. That is, these tables only work when forecasting installment loans or fixed-charge per unit loans that allow you to pay downwardly the balance over time.

Loans that volition not fit into an acquittal table include the following:

Interest-Simply Loans: Most mortgages are amortized loans, but others work in different means. Interest-merely loans, for instance, only require you lot to pay the interest on the loan for a certain amount of time. This is keen during the initial flow when just the interest is due, as it results in much lower payments. What y'all have to go along in listen, however, is that you're not paying off your principal at all during that fourth dimension. Somewhen, the interest-only catamenia volition come to an end and you'll be expected to either pay off the loan completely or outset making much higher payments that cover both the main and involvement.

Airship Loans: Balloon loans are similar to involvement-merely loans in that they're fun while they last. This is the kind of loan you lot'll merely desire to take out if you're expecting a huge payment at some point in the futurity. The monthly payments for airship loans start out pretty small-scale, but then, at some point, you'll be expected to either pay off the loan completely in a lump sum or refinance it, which isn't always a stable option. For example, many people lost their homes in the mortgage crisis of 2008 by counting on the refinancing choice.

Revolving Debt: Revolving debt is the type you become into when yous use credit cards. Considering you get to choose how much you lot borrow and pay dorsum each month, the master isn't always likely to stay the same, even if the interest rate does. The merely time you'd be able to use an acquittal table to pay off this type of debt would exist if you decided to no longer apply the credit menu anymore and dedicated yourself to just paying it off. Even then, however, it would only work if your interest rate never inverse.

Source: https://www.reference.com/business-finance/loan-amortization-table?utm_content=params%3Ao%3D740005%26ad%3DdirN%26qo%3DserpIndex

Post a Comment for "Reading Table Information for Completion of Table and Column Names"